First of all, I want to say I am an environmentalist (founder of EmissionsTax). I’ve believed in global warming since the day the concept was first explained to me. I thought it through, like I do every concept. Riding a bike for years as my only transportation, nothing bothered me more than breathing in smoke or smog. You will never realize how devastating car exhaust is to your lungs than when you are cruising through dense Los Angeles traffic on a bicycle.

I’ve also heard coal is pretty dirty – Acid Rain type stuff. I want to make this article a pragmatic and common sense explanation as to why sequestered coal power generation is the best choice for energy production in the US, and later to explain why the stock ARLP is a great value at it’s current price.

So Why do I want Coal for Christmas

Our world is heating up due to things we burn. Not just the emissions , but the actual heat of the combustion. We take solids and vaporize them,

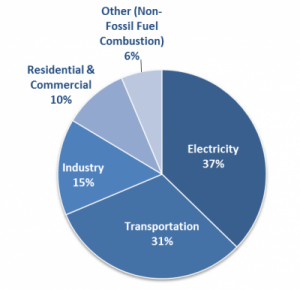

spreading a hot particle blanket across our atmosphere and tucking the polar bears in at night. To the right are the source of CO2 emissions currently by source in the US:

Now, if you look at the 37% Electricity rate, you will see how it is slightly larger than transportation. It does not show that there are at least 3 forms of combustible fuels used to generate electricity: Oil, Natural Gas, and Coal.

I read Power Surge by Ben Bova which talked a senator’s energy plan that was environmentally friendly and his struggles to get it passed. Introducing MHT technology and it’s ability to turn coal exhaust into methanol, a cleaner burning version of gasoline for transportation. This got me thinking a lot about efficient energy production.

Coal Pollution is More Localized

All these electric cars that Elon Musk and I want on the road are going to take a lot of juice to manufacture and operate. The volume of renewable energy is not available right now and will take many resources to and time to scale to the level we need. Coal infrastructure is already in place, and comparatively less expensive to put up new plants in both time and money.

Solar panels on cars? It might not be wise to lug around energy generation equipment, paying the cost to transport it. So now we have gasoline powered vehicles, creating thin smog clouds around our roads, highways and towns. Unless you are filtering the air you breath, you are inhaling those toxins 24/7, barring you live in the woods.

With transportation being the largest sole producer of CO2 emissions in the United States (transport is primarily petroleum products), it only makes sense to tackle that issue by reducing transportation emissions.

Gas Fumes Aren't Easily Captured

Power plant emissions are the most practical greenhouse gasses to sequester, or "capture". Though it is currently expensive, if we were to build new, smaller coal plants and sequestered the emissions, we could save on electricity . Coal producers or the power plants could sell sequestered coal products local to drink manufacturers, green houses growers and oil drillers for further inefficiencies.

The way to accomplish this is by imposing heavy emissions taxes, without the market place to buy and sell the caps, which will provide massive incentive for coal sequestration technologies. Funds generated from taxes could go to programs to plant trees and protect existing forests reserves (forests absorb green house gases), research for sequestration technologies and carbon dioxide products or anything. Emissions hurt the world public good, and so far, that damage has been pushed from the the people that use it

Why Alliance Resource Partners (ARLP) Stock for Me?

I'm fascinated by numbers, charts and graphs so I've been following the stock market for years studying the movements and market conditions, and advising some of my friends with more money than I. I get tips when it works out, plus have a little skin in the game.

| # of ARLP Shares Donated for To Continue My Work |

Alliance Resource Partners, one of the largest North American coal producers, and the high yield dividend it paid of around 13% a year around for roughly $26 a share. The stock ($ARLP) was trading in the lower quarter of its 52 week high of approximately $52, which I always like.

ARLP is Consistently profitable company formed in the late 70's, and undervalued in the current market. Share prices of ARLP have dropped 30% since then, getting whacked on Monday all the way down 8.86% to $14.86, with inexperienced traders pushing market orders off to hedge funds and other financial institutions (note to mark institutional ownership rates).

Recent warm weather, climate talks/fears and low commodity prices have pushed this high performing stock price down low. A 30% dip in stock price is a 30% increase in dividend bringing it to around 17% per year. Compounded quarterly through reinvesting your shares, you are at 20% on your money. What happens if the stock price goes up in a year?

The only thing that could go wrong is Alliance Resource Partners collapses all operations.

1 1/2 Year Update

ARLP is currently trading from $21-$24 a share, more than double the trading range. They have reduced their dividend by about 30% in May of 2016. Still, with that reduction, ARLP is paying a roughly 7% annualized dividend. If you had kept the stock and reinvest the dividend quarterly, You would have received 8-9% more stock when shares dipped into the $10-14 dollar range, it was dropped.A conservative estimate would show an 18 month return of over 20%, though I bet I could do the math and get a much higher number.

Alliance Resource Partners has cash reserves and remains profitable in tough market conditions. Coal is still big business.

2018 ARLP Stock Update

Roughly speaking, ARLP has been trading from $18-21 a share throughout the year. Today it's at $18, with an almost 12% annual dividend.

Compound that by reinvesting quarterly and you're looking at 14% or more return even if it stays the same price. Money in the bank.

2019 ARLP Stock Update

People and institutions are talking about divesting, or to stop investing in fossil fuel companies like Alliance Resource Partners.

The company is still profitable, though the just missed their revenue projections, causing a drop in stock price. Today - 10/28/19 the share price is just under $13, where it sat when I wrote this article in 2015.

Don't forget the the compound dividend over 4 years meaning fossil fuels are still a profitable investment.

Let’s Talk